“What is a Brand Ambassador (BA)?”

A person who is hired by an organization or company to represent a brand in a positive light and by doing so helps increase brand awareness and sales. It’s all about the brand. BAs can be paid $15 dollars and up for promotional services with the perks of free swag bags from the brand.

Brand ambassadors can foster strong emotional connections between customers and brands

(Me working the VIP section in Made in America)

Starting as a Brand Ambassador

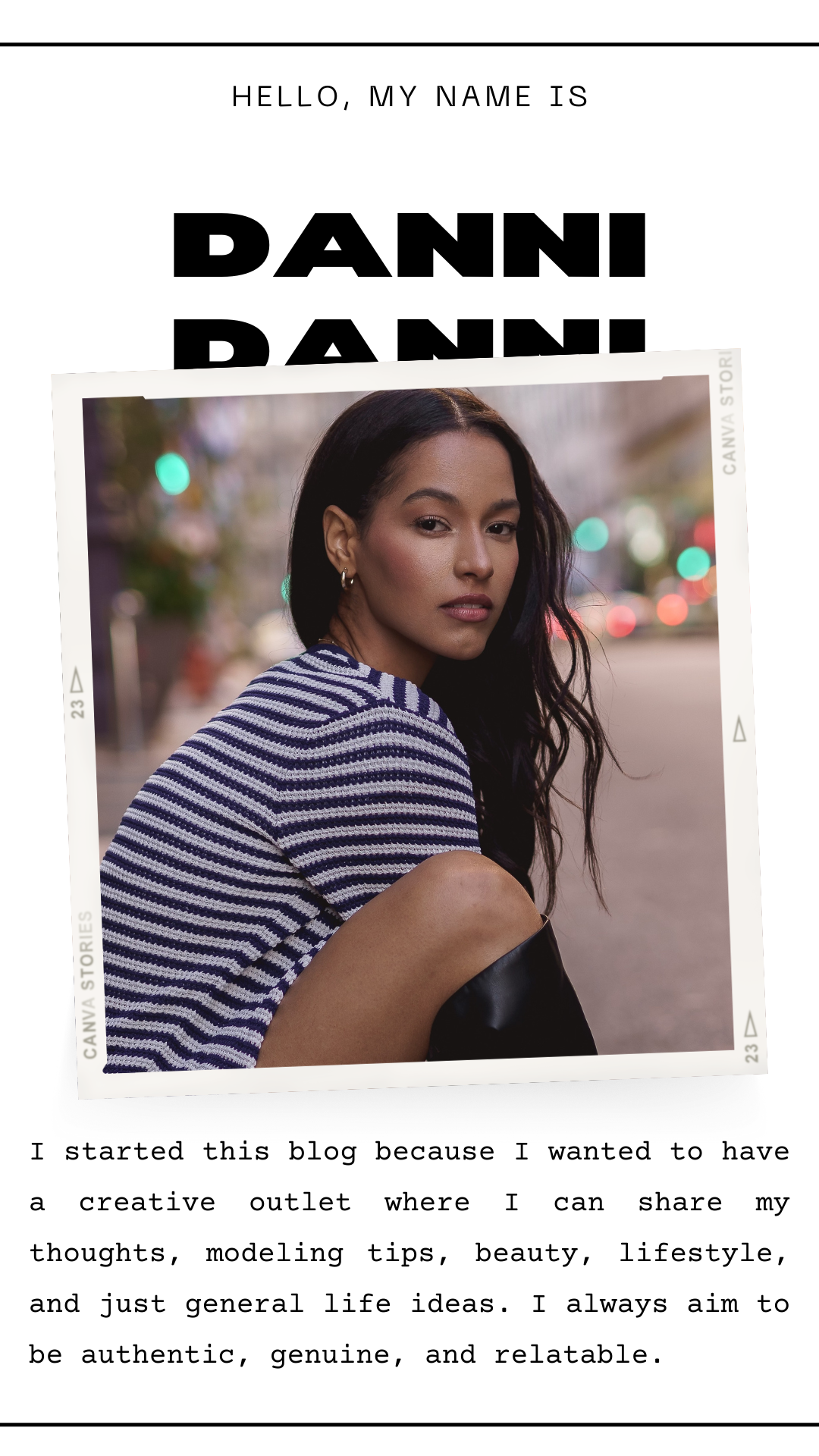

If you’re considering a career as a Brand Ambassador, it’s essential to begin your journey on the right foot. One key aspect is creating a strong online presence through realistic self-portraits, which can be the initial point of contact with potential employers. These photos should capture you as you are, without over-editing, and represent your true self.

While it’s not necessary to resemble America’s Next Top Model, quality photos can make a significant difference. Natural lighting is your best friend; it softens shadows and provides a flattering, authentic look. Aim to include 3-5 photos in natural lighting, with at least one showing your full body and a headshot. If you have experience as a BA, consider adding smiley pictures that showcase your genuine enthusiasm for the brand. Moreover, if you have professional photos from events where you’ve interacted with people, these can help demonstrate your socializing skills.

However, there’s a category of pictures you should never include in your professional portfolio, such as prom photos, family pictures, or graduation pictures. These belong to the realm of personal life and should not overlap with your brand ambassador persona.

What agencies to submit yourself too?

Finding the right agencies to work with is crucial for a successful career as a Brand Ambassador. A quick Google search of brand ambassador agencies can be a starting point, but not all agencies are created equal. Here are a few agencies that come highly recommended:

You can do a quick Google search of brand ambassador agencies to submit yourself too.

Here are a few agencies I have worked for and that I 100% recommend:

Popbookings (Database full of agencies): A database full of agencies, making it a comprehensive resource for potential BA gigs.

Trust Heard (Database full of agencies): Another database full of agencies, offering a wide range of opportunities.

Priceless One Management: Known for its quality BA opportunities.

Spitfire Event Marketing: Offers various BA gigs in different industries.

Creative State: Known for creative and diverse BA opportunities.

Disclaimer: Please do your own research. It’s essential to do your own research before signing up with an agency. You’ll be sharing sensitive information with them, so you need to be confident in their credibility and trustworthiness.

One of the most valuable tools for finding BA opportunities can be joining BA Facebook groups in your city. These groups often share insights about the agencies to apply to and which ones to avoid. Additionally, it’s beneficial to set a price range for yourself. While some gigs offer a low pay of $15, it’s important to note that not all BA jobs withhold taxes. This means you’ll receive the full amount upfront, but you’ll be responsible for paying taxes when you file. For this reason, some BA professionals avoid low-paying gigs, but it’s ultimately a personal decision based on individual circumstances.

Location & Parking

Before accepting a BA job, be aware of whether the brand’s agency will reimburse your parking expenses. Depending on the location of the event, parking costs can add up, and you want to ensure you’re not out of pocket for the hours you’re covering. It’s crucial to clarify this in advance to avoid any unexpected expenses.

So you have made it this far and landed yourself the gig!

Once you’ve secured a BA gig, showing up on time is vital. Word of mouth can significantly impact your future opportunities in the field, and reliability goes a long way. Emergencies do happen, and if you can’t make an event, try to notify your promoter as early as possible. Being professional and courteous in your interactions can help maintain a positive reputation. I found that being professional goes a long way.

Filing taxes

As a BA, it’s important to keep a record of all expenses related to your work. This includes expenses for lunch, transportation, parking, and learning costs. Saving receipts and documents is crucial for future reference when filing your taxes. Understanding the tax implications of your income and expenses is essential to ensure you meet your financial obligations.

Maintaining a detailed record of all expenses related to your work is indeed crucial. This practice helps you accurately track and manage your finances, as well as fulfill your tax obligations. Let’s dive deeper into the importance of recording various business expenses and the role of tools like QuickBooks.

Lunch Expenses: Keeping track of the expenses incurred for meals during business-related activities, such as client meetings or team lunches, is necessary. These expenses may be partially deductible for tax purposes, depending on the tax laws in your jurisdiction. By saving receipts and documenting these expenses, you can provide evidence and claim deductions when filing your taxes.

Transportation Costs: As a BA, you may need to travel for meetings, site visits, or conferences. It’s essential to record transportation expenses, such as airfare (Some gigs will fly you, For example, if you are a ring girl for tournaments), train tickets, or mileage if you use your personal vehicle. These expenses can often be deductible, either partially or in full, depending on the purpose and nature of your travel. Accurate documentation enables you to substantiate these deductions during tax filing.

Parking Expenses: If you frequently drive to client sites or attend meetings that require paid parking, it’s important to keep a record of these expenses. Similar to transportation costs, parking expenses may be deductible for tax purposes. By organizing and saving receipts, you can claim these deductions and reduce your taxable income.

Learning Costs: BAs can invest in professional development and learning opportunities to enhance their skills and stay updated with industry trends. This may include attending conferences, and workshops, or purchasing books and online courses. These learning costs can often be deductible as business expenses, providing you with tax benefits. Maintaining records of these expenses helps you accurately assess and claim the deductions you’re eligible for.

Receipts and Documents: Saving receipts and relevant documents is crucial for future reference and tax filing purposes. By keeping organized records, you can easily retrieve the necessary information when preparing your tax returns. This practice also helps you maintain transparency and comply with any potential audits or inquiries from tax authorities.

Tax Implications: Understanding the tax implications of your income and expenses is vital to ensure compliance with tax regulations. Different countries and jurisdictions have unique tax laws, deductions, and reporting requirements. By familiarizing yourself with these regulations or consulting with a tax professional, you can optimize your tax planning and ensure that you meet your financial obligations.

QuickBooks (Golden Tool for me!): QuickBooks is widely recognized as a powerful financial management tool for businesses of all sizes. It offers features that facilitate expense tracking, invoicing, tax calculations, and financial reporting. By using QuickBooks or similar accounting software, you can streamline your expense management processes, automate calculations, generate reports, and simplify tax preparation. These tools often provide integrations with credit cards and bank accounts, making it easier to import and categorize expenses.

As a BA, maintaining a record of all work-related expenses is essential for financial management and tax compliance. Saving receipts and documents enable you to substantiate deductions and accurately report your income. Understanding the tax implications of your expenses helps you optimize your tax planning. Utilizing tools like QuickBooks can streamline expense tracking and simplify financial management tasks.

Network

Lastly, communication with other brand ambassadors is invaluable. Many experienced BAs have been in the field for years, and they can provide insights and advice that go beyond the basics. By sharing tips, experiences, and knowledge, you can learn from the collective wisdom of your peers and continue to grow in your role as a Brand Ambassador. Whether you’re a newcomer or a seasoned pro, there’s always more to discover and learn in this dynamic field.

In conclusion, being a Brand Ambassador is not just about showcasing a brand’s products or services; it’s about embodying its values and connecting with the target audience authentically. The journey begins with building a professional portfolio, finding the right agencies, and understanding the financial aspects of the role. Success in this field is not solely determined by your appearance, but also by your dedication, professionalism, and networking skills. By continuously learning and growing, you can carve out fulfilling and successful gig jobs as a Brand Ambassador.

The world of modeling is a captivating yet enigmatic one, often shrouded in misconceptions and unanswered questions. Whether you’re an aspiring model or simply curious about the industry, you’ve likely pondered some of the most common queries surrounding this glamorous profession. In this blog post, we aim to demystify the modeling world by answering the most popular questions.